Backdoor Ira Contribution Limits 2024. How does this add up? Roth 2024 limits fifi katusha, these limits saw a nice increase,.

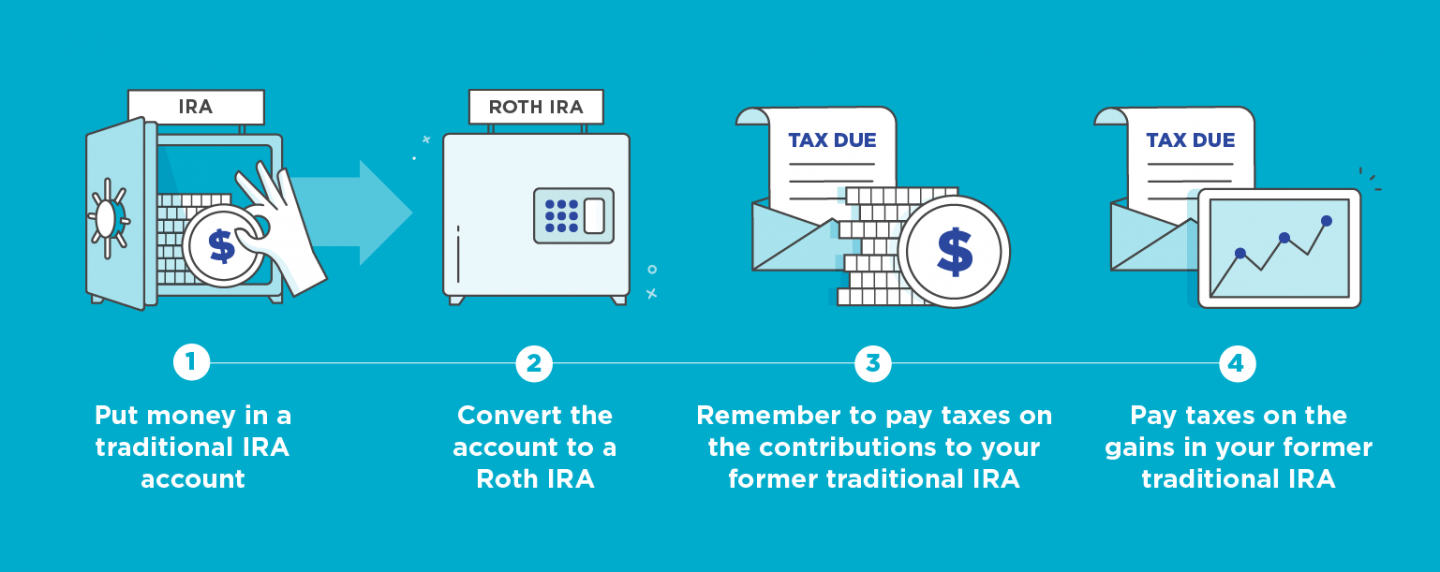

In 2024, the contribution limit is $23,000 if you’re under 50 and $30,500 if you’re over 50. So if your magi for the 2024 is less than $146k (single filer) or less than a total between the two of you of $230k (married filer), then you have no need to employ the backdoor contribution strategy and can directly make up to the maximum contribution for.

The Ira Contribution Limit For 2023 Is $6,500 Per Person, Or $7,500 If The Account Owner Is 50 Or Older.

You can’t contribute more than.

The Roth Ira Income Limit To Make A Full Contribution In 2024 Is Less Than $146,000 For Single Filers, And Less Than $230,000 For Those Filing Jointly.

[1] if your income is above the limit, a backdoor roth might be a.

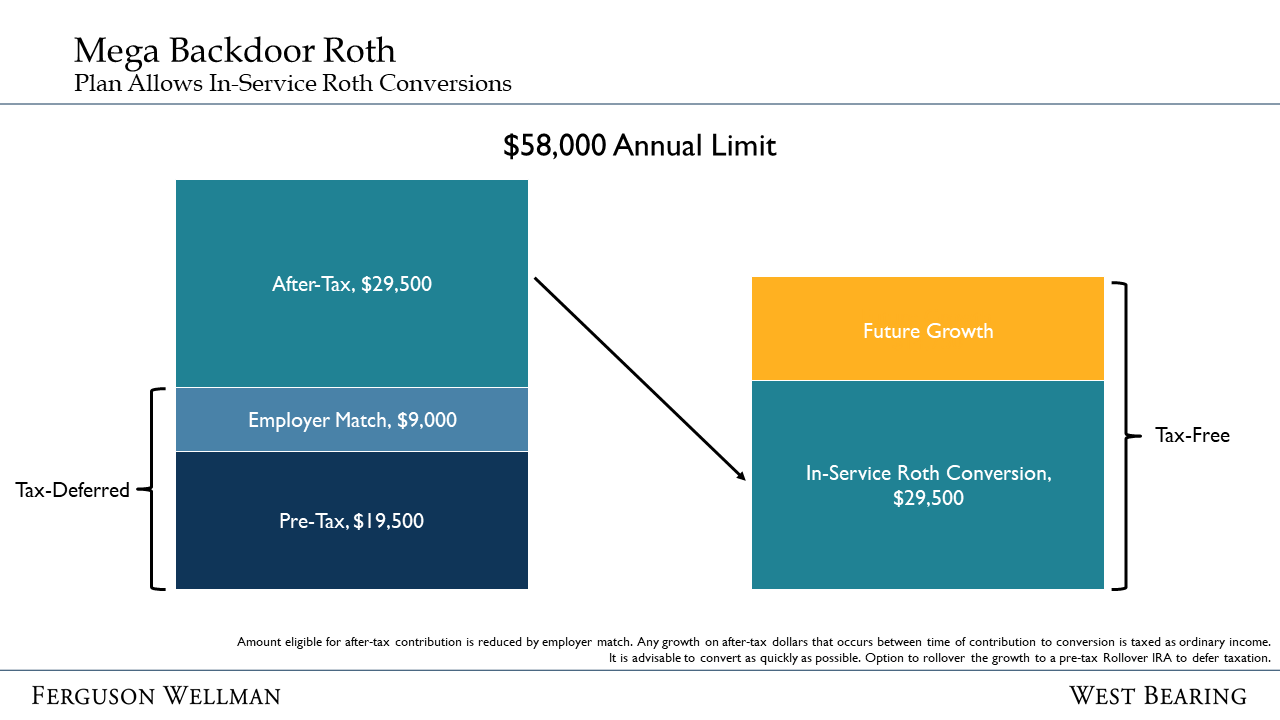

The Mega Backdoor Roth Allows You To Save A Maximum Of $69,000 In Your 401(K) In 2024.

Images References :

Source: nanceewadah.pages.dev

Source: nanceewadah.pages.dev

What Is The Limit For Ira Contributions In 2024 Ilysa Leanora, How does this add up? For 2024, the income limit for roth iras is $161,000 for single filers and $240,000 for married individuals filing jointly.

Source: ardisjqcarissa.pages.dev

Source: ardisjqcarissa.pages.dev

Mega Backdoor Roth Limit 2024 Cris Michal, The maximum ira contribution limit for 2024 is $7,000 for most account holders and $8,000 for those aged 50 or older. Ira contribution limits for 2023 and 2024.

Source: www.financestrategists.com

Source: www.financestrategists.com

IRA Contribution Limits 2024 Finance Strategists, A “backdoor” roth ira allows high earners to sidestep the roth ira’s income limits by converting nondeductible traditional ira contributions to a roth ira. The maximum total annual contribution for all your iras combined is:

Source: lauriqdarelle.pages.dev

Source: lauriqdarelle.pages.dev

Mega Backdoor Roth 2024 Limit Bessy Charita, The roth ira contribution limit for 2024 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older. You can contribute the lesser of your earned income or $7,000 to a traditional ira in 2024, which you can then convert to a backdoor roth ira.

Source: arlyneqjaquenette.pages.dev

Source: arlyneqjaquenette.pages.dev

2024 Roth Ira Contributions Abbye Annissa, The mega backdoor roth allows you to save a maximum of $69,000 in your 401(k) in 2024. The contribution limit for 2024 is $7,000 ($8,000 if you’re age 50 or older).

Source: www.theentrustgroup.com

Source: www.theentrustgroup.com

IRS Unveils Increased 2024 IRA Contribution Limits, How much can you convert with a mega backdoor conversion in 2024? The first is a low contribution cap.

Source: fancieqpatience.pages.dev

Source: fancieqpatience.pages.dev

Backdoor Roth Ira 2024 Darb Minnie, Here's how those contribution limits stack up for the 2023 and 2024 tax years. The resulting maximum mega backdoor roth ira contribution for 2024 is $46,000, up from $43,500 in 2023 if your employer makes no 401(k) contributions on your behalf.

Source: bonneeqvivian.pages.dev

Source: bonneeqvivian.pages.dev

2024 Ira Limits Ajay Lorrie, The table below lists the annual income thresholds that limit roth ira contributions. With the passage of secure 2.0.

Source: www.youtube.com

Source: www.youtube.com

2024 IRA Maximum Contribution Limits YouTube, Roth 2024 limits fifi katusha, these limits saw a nice increase,. If you earn more than these limits, you may still be able to contribute to a roth ira, but your contribution.

Source: mehetabelwvalry.pages.dev

Source: mehetabelwvalry.pages.dev

Calculate Sep Ira Contribution 2024 Alie Lucila, Backdoor roth ira income limits. The maximum total annual contribution for all your iras combined is:

The Resulting Maximum Mega Backdoor Roth Ira Contribution For 2024 Is $46,000, Up From $43,500 In 2023 If Your Employer Makes No 401(K) Contributions On Your Behalf.

Roth 2024 limits fifi katusha, these limits saw a nice increase,.

That Typically Requires You To Pay Income Taxes On Funds Being Rolled Into The Roth Account.

The maximum total annual contribution for all your iras combined is: